The threat to cash, why it matters, and what we can do

A little-publicised UK Treasury Committee inquiry, and the bigger picture

I have been planning a post on cash for a while now, and I had anticipated putting out an article something like this one in the New Year, following some other posts to provide additional context.

But then I saw that the UK Treasury Committee is inquiring into whether there is a need in the UK to regulate or mandate the acceptance of physical cash in the form of notes and coins:

The inquiry was announced on 4th November, and the closing date for submissions is Monday 2nd December!

The acceptance of cash is something that affects all of us, and particularly those “groups in society that disproportionately rely on businesses and public services accepting their cash” (in the words of the Treasury Committee’s Call for Evidence).

Hence another unscheduled post, following yesterday’s re the extraordinary recent blitz of Assisted Dying adverts1 on the London Underground near Westminster in the run-up to a Parliamentary vote on a Private Member’s Bill.

The threat to cash

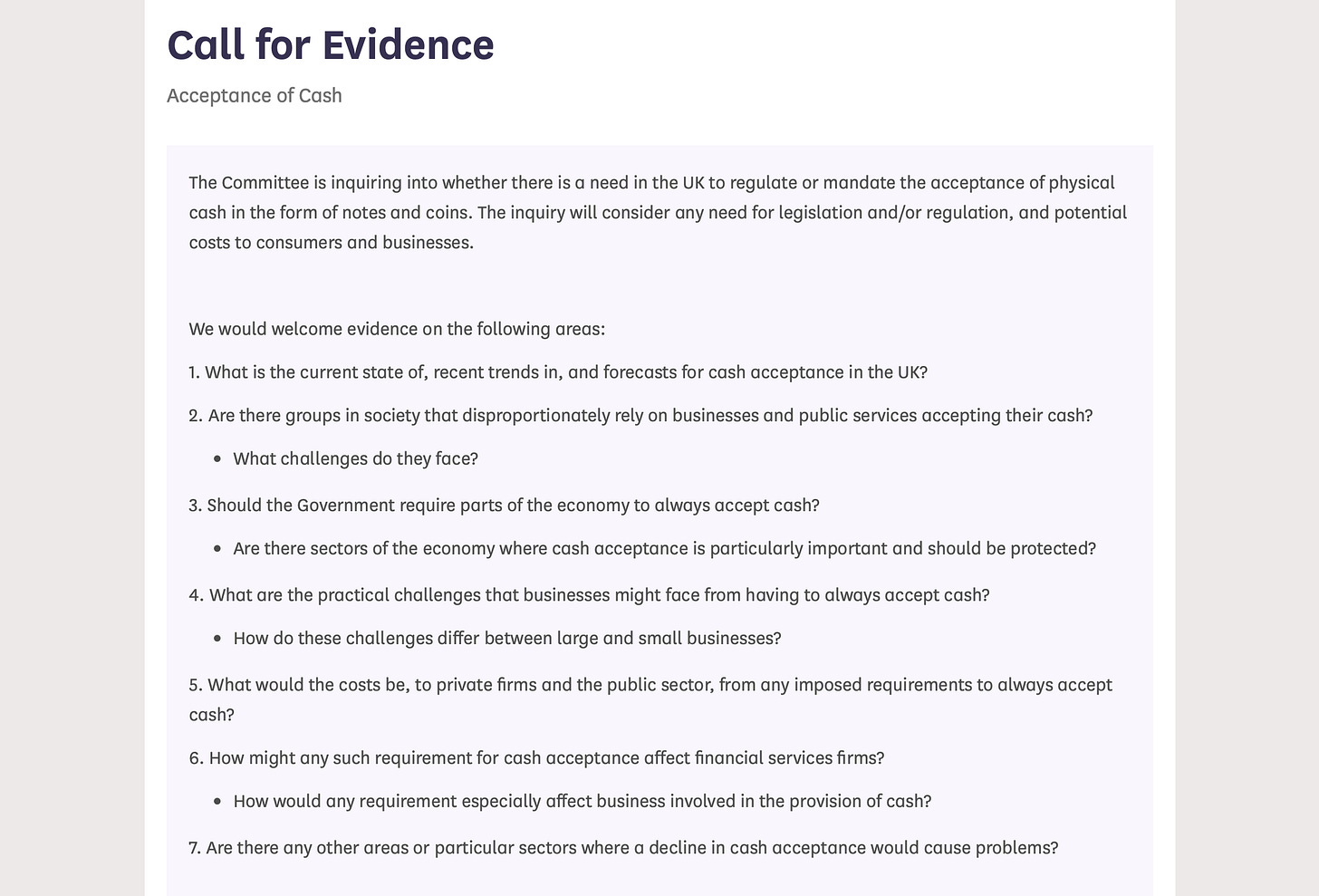

This is the Call for Evidence in full:

In the context of the above, the use of the phrase “threat to cash” might seem somewhat alarmist. But to my mind the fact that Question 3 is even being asked should be a cause for concern. I hope that the rest of this post will help to explain why.

In practical terms, this Treasury Committee inquiry does not involve answering pages and pages of questions. After inputting minimal personal details — surname and email address suffice — the instruction is to upload evidence as a single file:

Why it matters

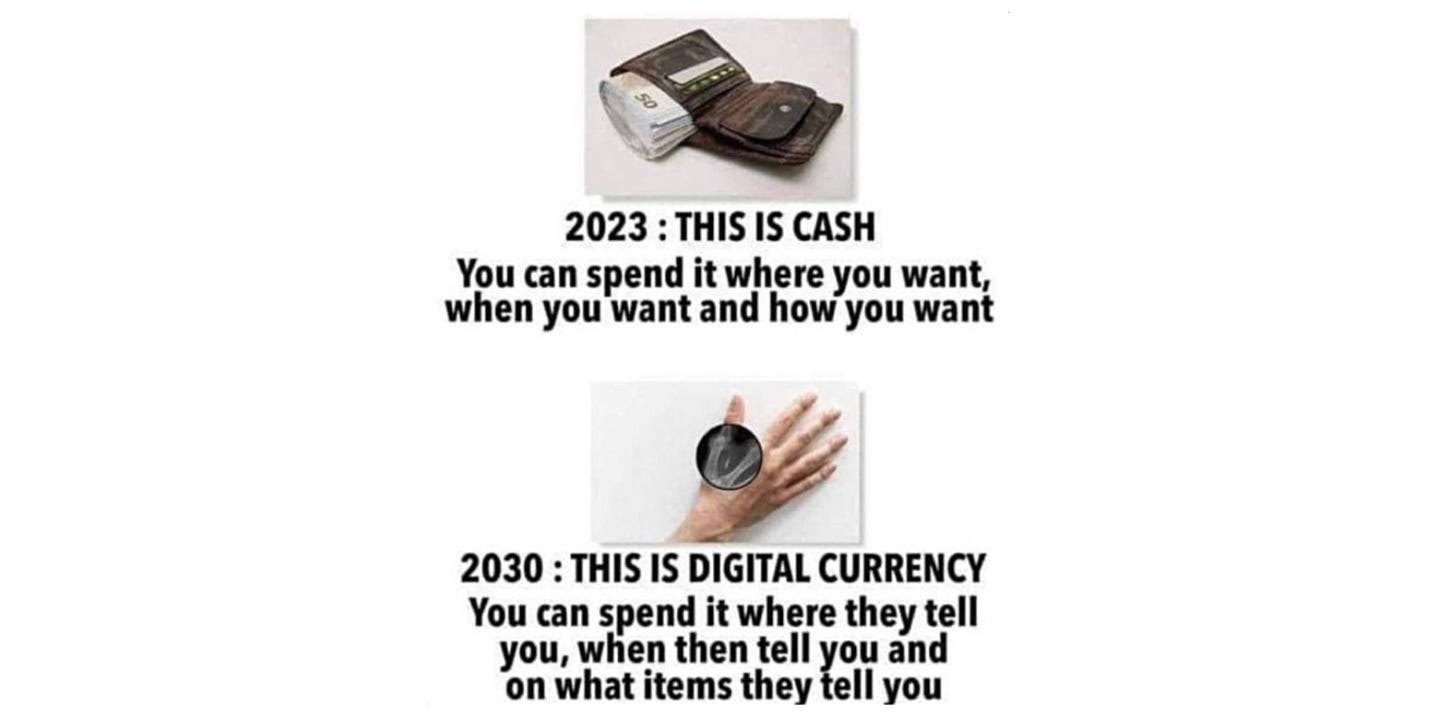

There is much that could be said about why cash matters, but the bottom line is expressed succinctly in this meme that outlines what our invisible governors have planned for us:

It’s a question of freedom.

If, for example, the authorities wanted to force us to stop flying, and driving, and eating red meat — to achieve “Net Zero” in the context of a “climate emergency” — how might they do it? One way would be to introduce a Central Bank Digital Currency (CBDC) where transactions are conducted with digital money that can be programmed to ration (or prohibit) the purchase of certain items.

If that sounds alarmist, consider e.g. any or all of the following:

2019 UK Fires publication

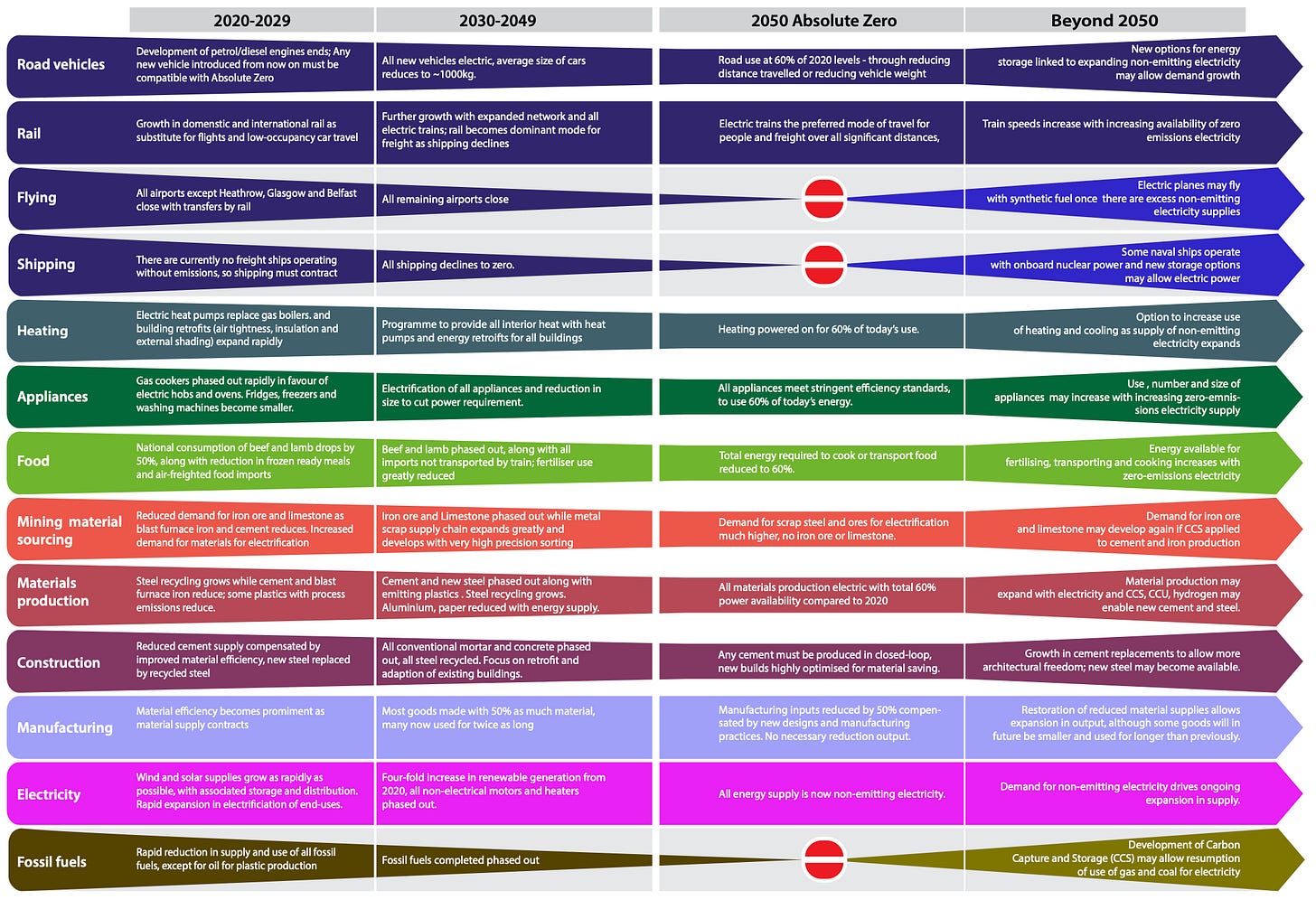

This diagram from p6-7 of a 2019 UK government-funded University of Cambridge report from UK Fires:

NB the implementation of the recommendations of such a report might start with restrictions “for our health” such as limits on how much sugary food we can buy, or how much tobacco, or alcohol.

It would hardly be surprising if the Nudge Unit was at work again. This post provides some context on the sort of behavioural psychology involved:

The Bank of England

These two webpages from the Bank of England website:

And if you really think they mean it when they say a digital pound would not replace cash, think back to when the Health Secretary said in Parliament that:

The [covid] vaccine will not be used for children. It has not been tested on children. The reason is that the likelihood of children having significant detriment if they catch covid-19 is very, very low. This is an adult vaccine for the adult population.

A video of a similar statement can be found here:

Ed Dowd interview

This April 2024 interview with Ed Dowd, a former BlackRock portfolio manager featured in this post:

Particularly from 25:55-29:18 (transcript below, emphasis added):

[Dowd] The CBDC… I’m against it because I know the abuse of power that can be made with it. Basically you can link it to everything. So you can start to impose social controls on people, you can debank people — turn off their bank account if you want to. So it’s kind of a modern-day slavery system…

If somebody got into the office and was a vegan and said, “We’re going to impose meat quotas,” technologically they’d be able to prevent you from buying more meat at the grocery store, meaning the [cashier] couldn’t even transact for you. It’s that kind of control, and that kind of control we always know will be abused. So… I love cash, I’ve been to protest… I spend cash as much as I can in all restaurants, and when I go out shopping I pay in cash.

[Interviewer] Well we’ve actually had a situation here in Canada of all places — if you can believe it — where the government actually did that very thing against the trucker convoy. I believe that was two years ago but I’m sure you read about that?

[Dowd] That was a beta test, and what they didn’t count on was [that] the moment they did that the blowback was huge and there was an immediate fear in the financial markets where, if you were outside of Canada and you had money in Canada, you said, “I want my money back.” The banks figured that out pretty quickly… they started seeing fast movement and I think they went to the Trudeau folks and said, “You guys… no!”

[Interviewer] It’s hard to believe. In all countries in the world… never did I ever think that would happen in Canada… But they don’t they have Central Bank Digital Currencies in China?

[Dowd] I don’t know if they do yet. I think they’re testing them, but they have other methods of control… they have social credit scores… They have an AI system where if you go online and you say bad things about the government you can’t get an airplane ticket…

Re China’s social credit system, see e.g. this section of this post:

So I think I don’t think it’s a CBDC — it’s more just a monitoring system that is pretty Orwellian so to speak.

[Interviewer] And the whole motive or objective behind implementing Central Bank Digital Currencies is just to control the population? Is that right?

[Dowd] I think [that] ultimately… the people who are pushing this… that’s what they want. I think there are a lot of players in it that… think it’s great and convenient, and I think they’re just naïve.

We’ve seen this famous clip of a Bank of International Settlements banker speaking about how you can control many things with the CBDC, and he basically revealed the plot. He said, “We can control how people spend their money.” He said it.

And here it is…

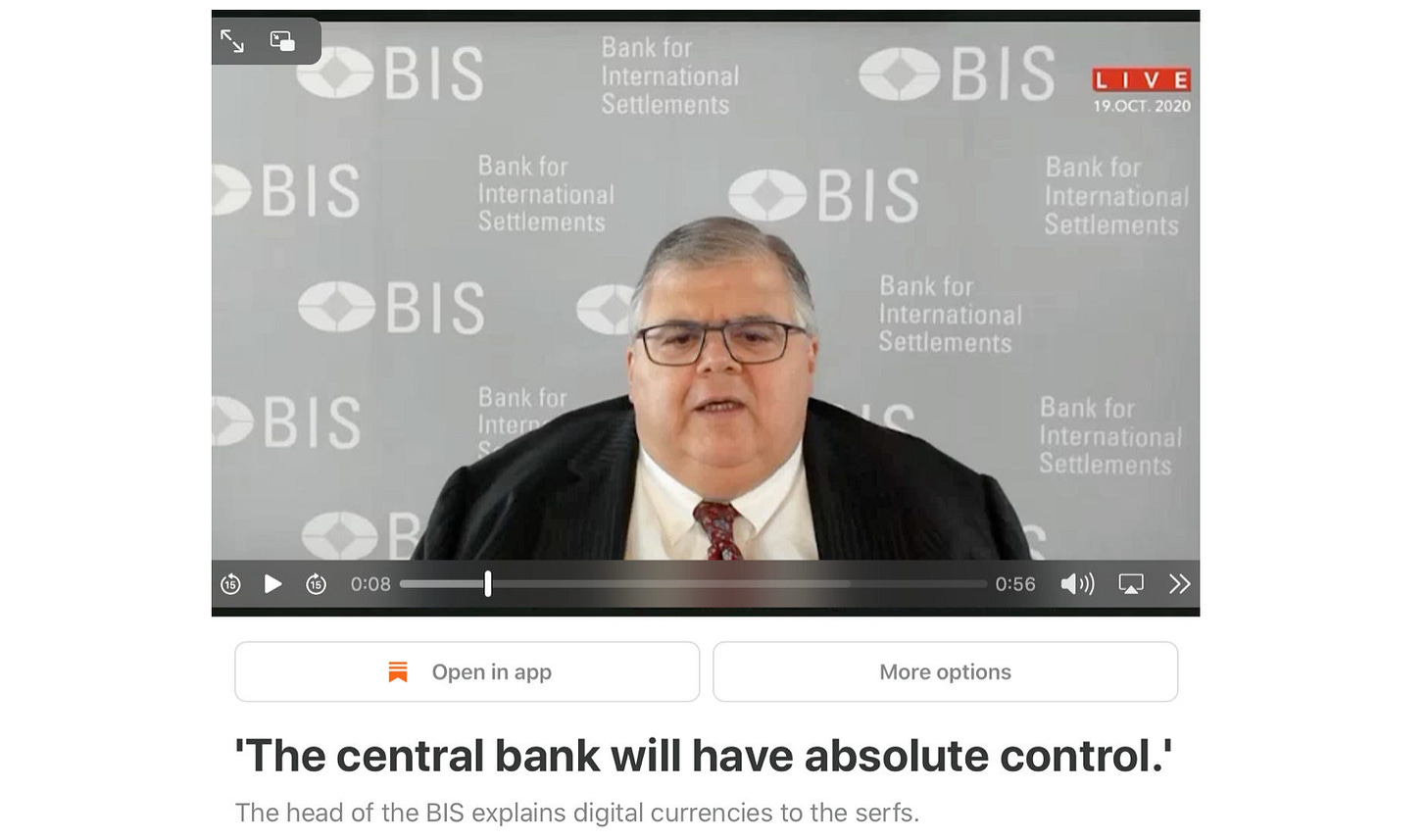

Statement from the General Manager for the Bank for International Settlements

This 2020 clip featuring Agustín Carstens, the General Manager for the Bank for International Settlements which serves as a bank for central banks:

Transcript (emphasis added):

“For… CBDC in particular for general use, we tend to establish the equivalence with cash, and there is a huge difference there. For example in cash, we don’t know for example who is using a hundred dollar bill today; we don’t know who is using a one thousand peso bill today. A key difference with a CBDC is that the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability. And also, we will have the technology to enforce that. Those two issues are extremely important, and that makes a huge difference with respect to what cash is.”

What happened in 2021

The sinister prospect of governments linking the use of digital money to the taking of “safe and effective” injections.

If that sounds far-fetched, remember that, in 2021, in some parts of Europe, a “covid pass” (or “freedom pass”) was required in order merely to buy food from supermarkets:

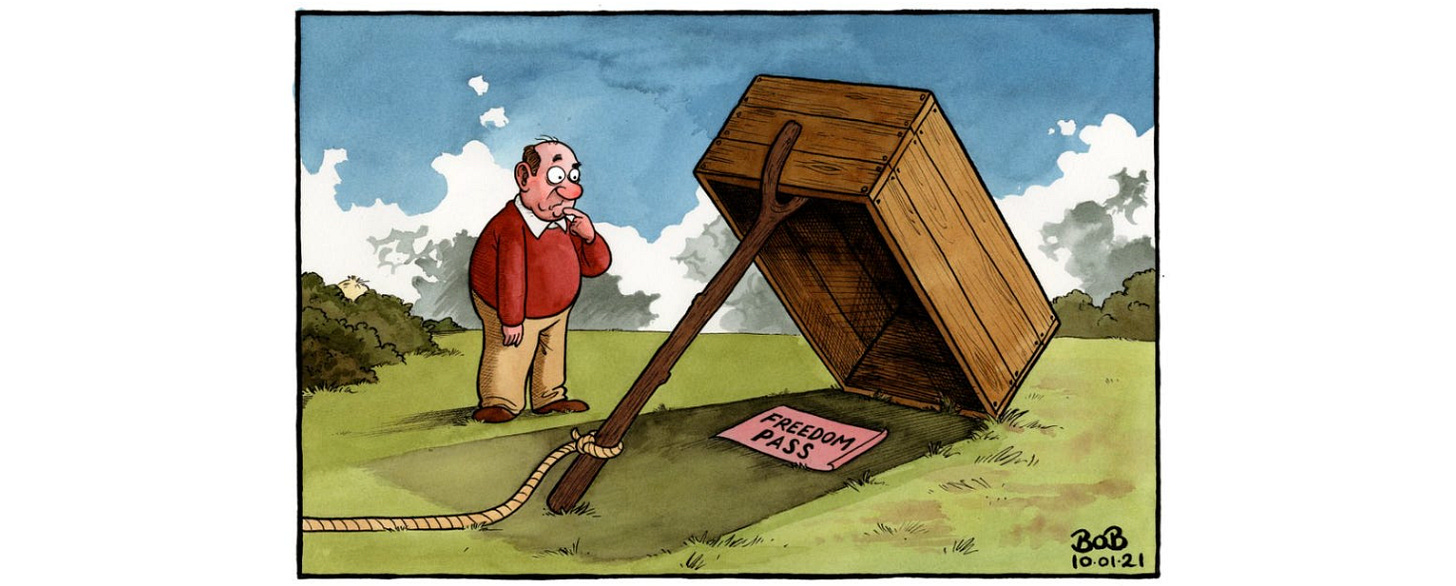

As former Telegraph cartoonist Bob Moran astutely observed, it was an odd sort of freedom being offered:

What we can do

So what can we do?

One obvious thing is to use cash wherever possible, even if it’s less convenient to do so. I have been paying for fuel with cash for a couple of years now, and using cash in shops, pubs and restaurants wherever practical. If I encounter a shop, pub or restaurant that refuses to take cash, I try to explain some of what I have outlined above. And I noticed recently that one bar in the city near where I live has gone back to taking cash after having previously gone cashless.

Raising concerns with supermarkets might help. I have written to express some of the concerns raised in this post, particularly in the context of the reduction of the number of staffed tills (where cash is accepted and there is interaction with human beings) and the rise of automated self-service checkouts (many of which do not accept cash).

Participating in government consultations like the one that inspired this post. Submissions do not need to be lengthy. And I suspect that many short submissions would have rather more impact than a few lengthy ones. Among other things, I plan to highlight concerns re freedom from authoritarian control and the practical implications of what happens in the event of a power failure or a cyber attack.

Related: this documentary (also available on Rumble):

Or see this four-minute trailer (also on Rumble), transcript in footer.2

Unexpected Turns homepage

The most-read articles can be found here

“Assisted Suicide adverts” would perhaps have been a better choice of title

Transcript for four-minute trailer:

[Caption] Central bankers have a system in place to take everything from everyone

[Caption] It happened before.

If you close all the banks, which is what [President Franklin D Roosevelt did in 1933] — he suddenly literally closed all the banks, and then only certain banks were allowed to reopen, which were the ones controlled by the [US Federal Reserve] [which is actually privately owned] — well… suddenly no-one had any money… It’s… hard to imagine when it’s all just shut down, suddenly…

[Caption] It’s about to happen again. They plan to confiscate everything.

It’s about suppression and subjugation, and that’s the lesson when you look at this period in the 1930s.

And that is what they have planned for this kind of a cycle again. And they’ve set up for it. So this plan to take all collateral globally, and to collapse the system in a kind of controlled demolition where they end up controlling everything… this design was set in motion over 50 years ago [with the abolition of the gold standard in 1971]

[Caption] With everyone in penniless fear, they will launch their digital slave currency CBDC.

Gold is not the underlying collateral in this system. It’s all securities globally, so they will be taken under the argument that… we have to save these systemically vital institutions so that we can restart the economy again. How could we restart the economy if they are not protected? So that will be the reason given, and it’s like a game of Monopoly where all of the pieces [and] all of the money on the board are pulled back to the bank. And then they say, “Let’s start a new game. We’ll start over from the basis that we have everything and you don’t. So, would you like to borrow something?”

It will be very difficult for people to refuse to use [the CBDC] because they literally won’t be able to eat. They will have an app they can download. This will be the “help”… the calvalry riding to the rescue [from whatever crisis or perceived crisis there is]…

“Just download this app and you can load your phone with some [digital] currency to allow you to go buy milk…” But every time you use that, you’re actually borrowing money from them. They have you again. It will happen very fast. This will unfold in a very frightening crisis kind of environment, and people will have difficulty refusing…

[Caption] If you think your “segregated” securities ownership will save you, it won’t.

Even segregated accounts — even people or institutions that have been told that their securities are segregated — are in the same pool, and entitled to only a pro rata share… in the event of an insolvency of the custodian. So, again, segregation is just an appearance. People are told that it’s an absolute subterfuge, and the shocking thing is that even sophisticated institutional investors do not understand this and they don’t want to know it…

[Caption] In the face of a financial crisis, awareness is the answer.